Everything About Chargeback and Fraud in Event Ticketing

With the alarming increase in chargebacks and fraud, especially in the event ticketing industry, it is important to understand and learn how to prevent fraud and how to respond to that.

Unfortunately, merchants, especially the ones dealing with digital merchandise or services are the victims of the credit card chargebacks that is designed in a way that is hostile to the merchant and in favor of the buyers.

More buyers are learning to abuse this system to get away with free merchandise or services.

We at Ticketor, take this issue serious and provide many state-of-the-art tools to prevent and respond to chargebacks.

What is a chargeback?

A chargeback is when a credit card holder, calls the card-issuing bank and request a charge to be reversed due to various reasons such as fraud (unrecognized or unauthorized charge) or not receiving the promised product or service in the expected quality.

When an individual applies for a credit card, the credit card issuer assures the card holder that they are protected against all fraud and they have zero responsibility for fraud. This is usually mentioned in the credit card’s term of use.

It means that the card holder can call the card issuer and request a reversal of a charge at any time.

What happens when a card holder requests a chargeback?

The issuing bank usually reverse the charge immediately back to the buyer’s credit card and issues a chargeback with certain code, that indicates the reason for chargeback.

The chargeback is then sent to the payment processor of the merchant (seller).

The payment processor takes the disputed amount plus a penalty of usually $15 to $25 from the merchants account or puts a hold on it.

Then the payment processor sends the chargeback to the merchant.

The merchant is responsible for the full dispute amount plus the penalty.

The merchant is given a one-time chance to resolve the issue with the buyer and have the buyer reverse the chargeback or provide evidence and documentation in response to the chargeback.

If the merchant responses to the chargeback with evidence before the due date, the response is sent by their payment processor to the buyer’s card-issuer bank and the buyer’s card issuer bank will decide based on the evidence if the chargeback stands or it should be reversed. Usually, the payment processor just provides the tools to transfer the response and is not involved in decision making.

Unfortunately, most of the time, banks stand with their card holders and most chargeback responses get rejected. Especially if the charge is for digital or non-tangible items that do not require physical shipping and do not have a proof of shipping.

In some cases, the merchant may take the case to the next step or arbitration.

Who is responsible to pay for the chargeback or fraudulent amount?

Unfortunately, the merchant is responsible to pay back the full money, even though they may have already shipped the merchandise. The money is usually drafted automatically from the merchant’s bank by their payment processor, or is deducted from their coming settlements.

In the case that the merchant’s payment processor is not able to retrieve the money from the merchant, such as if the merchant is already out of business or does not have enough funds in their bank, the payment processor would be responsible to cover the funds.

That is why payment processors do through credit check on the merchants before issuing them a payment processor. They also hold to the sales money for a few days, depending on their risk assessment, before releasing the money to the merchant.

Also, if a merchant receives too many chargebacks, the payment processor may consider them too risky and close their account.

What is a chargeback code?

When you receive a chargeback, it comes with a chargeback code and description.

The code explains what is the reason for chargeback and it is very important to understand the chargeback reason, before responding to the chargeback. The chargeback codes may differ from network to network. For example, Visa may use different chargeback codes from MasterCard.

You can always Google the chargeback code for more description about the chargeback.

Types of chargeback codes

While there are many chargeback codes, the main ones can be categorized in 2 categories:

1- Fraud Chargebacks:

A fraud chargeback is when the buyer claims that they do not recognize or did not authorize the charge. It is usually the hardest type of chargeback to fight against and win.

It may be due to a lost or stolen credit card or the credit card information, or somebody in their household like a spouse or roommate using their credit card without their permission!

Or it can be just an abuse by the card holder or a trick to get refund on a non-refundable item; or the buyer may find it easier to contact the credit card and file a chargeback than calling the merchant and request a refund or cancel a service; or the abusive buyer may just want to receive the item for free.

So, fraud chargebacks can also be categorized in 2 categories:

1-1 Real Fraud

It is usually a stollen card or card number. The buyer in this case is usually also a victim but they can get their money back by filing the chargeback, which makes the merchant the real victim.

1-2 Friendly Fraud (Abuse)

It is usually an abusive user, trying to take advantage of the credit card system.

2- Non-fraud Codes

Non-fraud codes can be due to many factors related to the purchase or service. It could be a buyer who never received the ordered items or received a broken one or the purchased item didn’t work as advertised.

In ticketing industry, it could be due to a cancelled or rescheduled event, a low-quality event or service, or an attendee’s bad experience.

And of course, the abusive buyers who would like to take advantage of the system and are looking for an excuse to request their money back.

The expectation is that if the buyer does not receive their order or the item is broken, they should first contact the merchant and try to resolve the issue. However, this is not required for filing a chargeback and the buyer can go directly to the card issuer and file a chargeback.

How to Prevent or Minimize Chargebacks and Fraud

As chargebacks and frauds affect all merchants across all industries, both online and in-person, it is an important matter and many industries and standards are trying to minimize and stop it.

Preventing Fraud By Card Issuers, Card Network, Payment Processors and the Industry:

Banks, card issuers and payment processors use state-of-the-art, complex algorithms to identify the fraud, right before they approve a charge. They use all data available to them, including analyzing the buyer’s behavior that led to the purchase, the buyer’s historic behavior and type of transactions they have done in the past, a sudden increase in the transactions on the card, the geographic location of the transaction or the IP and GEO-location of the buyer, the device they are purchasing on and many other factors.

If the transaction looks too risky to them, they may block the transaction and may send a text or email to the buyer asking for verification.

They also support text/email notification that they send to the card holder on every successful transaction, so, if the transaction is fraudulent, the buyer can take action right away to block the card to prevent more fraudulent charges.

Pre-chargeback notification:

Some payment processors, such as Stripe, may also send you a pre-chargeback or early chargeback notifications, as soon as they become aware that one of your transactions may be fraudulent or you may receive a chargeback for that.

It allows you to prevent the damage if the item is not shipped yet or the event is not held to cancel the invoice. It also allows you to make a refund to avoid the chargeback fee (penalty).

Chip / Tap Instead of Swipe

In the in-person transactions world (card-present transactions), card network recently introduced the chip and tap methods, instead of the swipe, which makes the transaction much more secure and significantly reduce the chance of fraud. If a merchant uses the chip or tap method, it usually transfers the responsibility for fraud from the merchant to the card issuer. Which means if a fraud chargeback is later issued, the bank is responsible for covering the charge and not the merchant.

CVV and Address Verification

In the online transactions, card-not-present transactions, the card network can collect and validate the CVV (3- or 4-digit card code). In some countries, like US, there is also another system in place called AVS (address verification system). If used, it can validate the cardholder’s billing zip code and / or cardholder’s billing address number.

These validations have been around for a long time and if used can help reduce the fraud.

3DS (3D Secure)

The industry recently introduced a new method called 3D Secure or 3DS, which significantly reduces chance of fraud. If 3DS is used for a transaction and supported by the card-issuer bank, the buyer will have to complete a verification step during the purchase. It could be something like:

· Entering a code sent to their mobile

· Or confirming the transaction through the notification they receive from their banking app

· Or maybe logging in to their bank account

While 3DS has became legally mandatory in some countries like the EU countries, it is still optional in US and some other countries or may not be fully supported by all banks.

3DS, similar to chip / tap methods, usually transfers the responsibility of fraud from the merchant to the card issuer. Which means if a fraud chargeback is later issued, the bank is responsible for covering the charge and not the merchant.

While the transfer of responsibility sounds very good to the merchants, there is one issue and concern with 3DS. Since it adds additional challenge to the purchase process, some legit buyers may drop out or not complete the purchase due to added complexity. Continue reading to learn how Ticketor can deal with this issue.

Preventing Fraud and Chargebacks by You, Using Ticketor

Ticketor understands the pain of merchants and how chargebacks and disputes affect their bottom-line. As a result, we have come up with tools to help you best prevent and manage the chargebacks.

1- Name and Phone Number on The Statement

It is important that the name that appears on the buyer’s statement is a familiar name to the buyer, so the buyer can easily recognize the charge and not accidentally dispute the charge. It is also helpful to accompany the name with a phone number so the buyer can call if they have any questions or concerns.

Ticketor allows the event organizers to use their own payment processor and so your name and phone number will show on the buyer’s credit card statement which should be more familiar than a ticketing company name.

You should set the name and phone number on your payment processor and also on Ticketor. Ticketor clearly communicates the name to the buyer to set their expectation.

2- Fraud Rules

CVV, billing zip code and billing address number validation

It is important that you collect and validate all the data that can be validated by the card issuer, including CVV, billing zip code and the numeric part of the billing address line.

Ticketor collects all these information and passes them to the payment processor, however, you should set the rule to reject the transactions which fail any of these validations. If any of these validations are not available for that specific card or card-holder’s country, then it is ok to skip that validation.

Most payment processors support options to switch validation on or off.

While these validations are free with most payment processors, some actually charge a small amount.

3DS (3D Secure)

If 3DS is optional in your country, such as US as of the date of this article, it is important to make the best use of it anyway. It is a great tool that significantly reduces the chance of fraud and in case of fraud, it most likely transfers the responsibility to the card issuer.

Your payment processor may give you an option to make 3DS on or off.

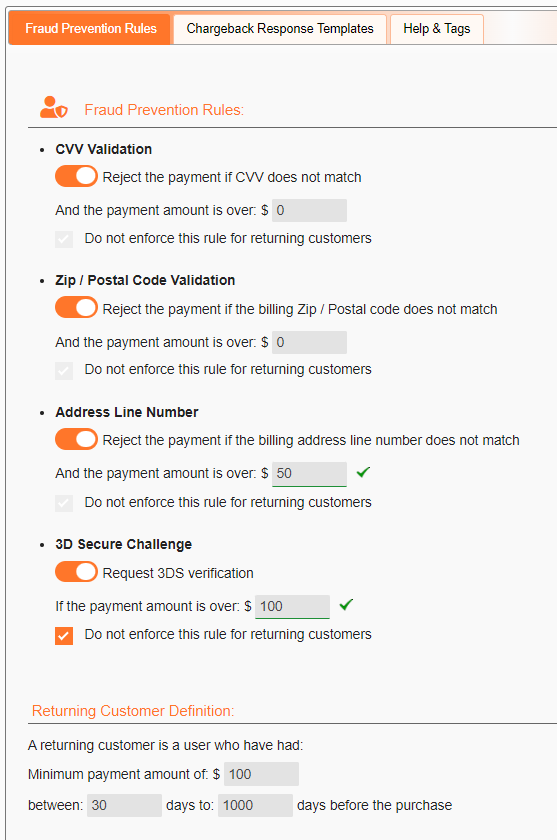

Ticketor’s Rule-Base Validation

|

Ticketor actually offers a more efficient method to control and validate CVV, billing address and 3DS.

As mentioned before, all these validations, especially 3DS, come at an extra challenge for the buyer and may cause the legit buyer to give up the purchase.

Ticketor’s fraud rules, allows you to determine what validations to be used based on some risk factors, including the amount of transaction and if the customer is a new or returning customer.

You can set a threshold amount for each validation method to kick in and you can skip the validation for existing customers who made certain amount of purchase within a timeframe before this transaction.

It allows you to specify harder validation rules for bigger purchases by new customers, while making it easy for smaller transactions and for returning customers.

|

|

3- Blocking the Abusive Users

If a user has been abusive or has unfair chargebacks in the past, you may want to block them from making purchases on your site.

Unfortunately, blocking abusive or fraudulent users online, may not be that easy.

An individual may create and use unlimited number of emails, phone numbers (fake or real), IP addresses using VPN, or fake names to get around the blocking. They may also have multiple credit cards or virtual card numbers, and may have multiple billing addresses and multiple devices or use incognito mode to not get recognized.

So, blocking a user just by email is not effective at all.

Ticketor’s Smart-Block Solution

Ticketor’s smart-block is the most effective way to identify and block abusive buyers.

Smart-block, tries to use all these information to identify a blocked user, prevent their future purchases, and collect new information from the blocked user to automatically add them to the block list. Blocking the billing address, is the most effective way, as it is connected to e physical property and along with address verification, it makes sures that the buyer cannot use a random address.

You can smart-block a user in Ticketor’s User Manager. Similarly, you can unblock a smart-blocked user.

When you Smart-Block a user, the system uses all their information, including all the information provided in the previous purchases, and add them to the block list. It includes their email, phone number, credit cards, billing addresses, etc.

When a user tries to make a purchase, the system tries to match their provided information with the ones in the block list. If it finds a match, it blocks the purchase with a generic error and adds all the provided information to the block list. It also marks the computer / device as blocked to identify them if they use different information with the same device.

4- Adding additional warning on the checkout page

You can add any warning to your term of service and have the buyer agree to that, however most buyers do not read the terms and so, it is not effective.

With Ticketor, you can add a checkbox with a warning that the buyer must check to complete the purchase.

The warning may ask the buyer that if they have any concern with their purchase, they must first contact you and not their credit card company and warn the buyers that if they file a chargeback, they may permanently get blocked from your events.

This warning, along with the smart-block tool that allows you to actually enforce it will help reduce chargebacks from abusive clients.

5- Non-Credit-Card Payment Methods

While credit card charges can easily get disputed or reversed, there are other payment methods available in different countries that are non-disputable and are considered final, like a cash payment. Meaning that as soon as you make the payment, you cannot get your money back.

Many money transfer apps such as Zelle, Venmo, Cash App, Wise, or bank transfers are among the methods that are hard to dispute. Read their term of service to find the best one for you.

These methods usually have no fee or significantly lower fee compared to credit card processing fee.

While paying with these methods may not be as convenient and as fast as paying with a credit card, they may be a good alternative for high-risk businesses. Or you can offer them along with the credit card payment option, and optionally offer some discount or incentive for the buyers to use these methods.

Most of these methods are not real-time and do not offer API to integrate with a website and e-commerce system.

Ticketor has come up with a creative method to allow payments using these methods.

Responding to Fraud and Chargeback

If a chargeback happens, it is important to try to resolve it or respond to the chargeback with as much evidence as possible.

The evidence could be all the information collected from the buyer when they signed up on your site and made their purchase, information on their attending the event and when their tickets got scanned, and any previous purchases or history from the buyer.

Collecting these information is usually very time consuming and may need hours to prepare a response.

The response should be written with considering the chargeback code, available evidence and history.

Some clients hire legal professionals to write a good response while others may come up with their own response or something they find on the internet or using AI tools.

Ticketor’s One-Click Response

|

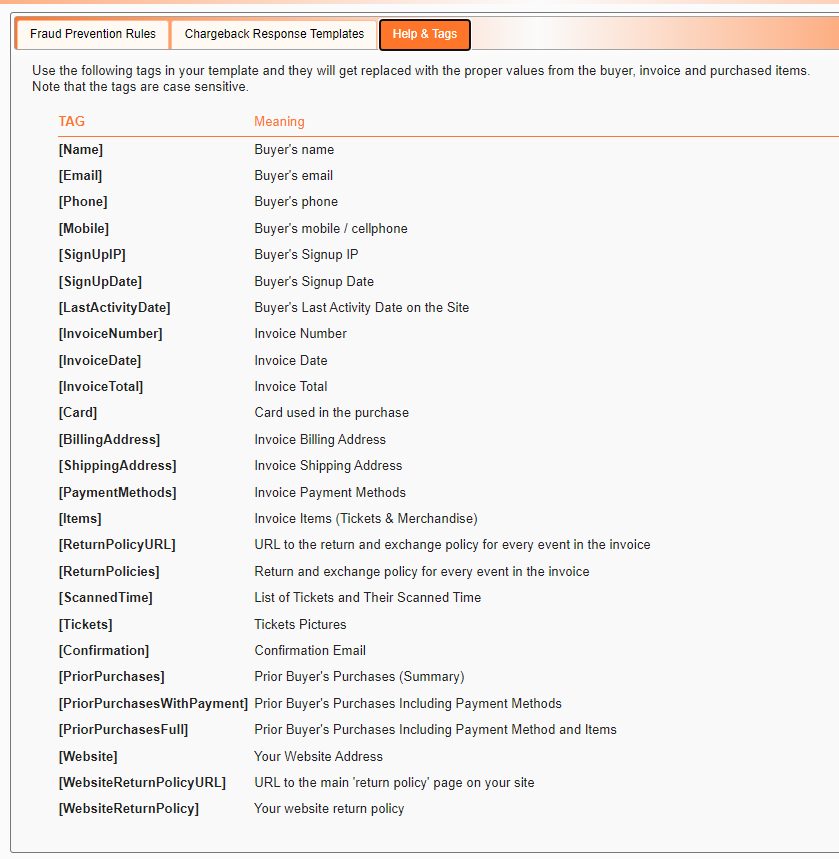

Ticketor makes it really easy to prepare a chargeback response. The system allows you to create multiple templates, for different chargeback codes and for different scenarios.

The templates will include TAGS that system will replace with the buyer information, transaction and invoice information, return policies, and users previous purchases and history.

Simply, select the disputed invoice, click to prepare chargeback response, select the template and the system will prepare the chargeback response using the template and the information from the buyer and invoice.

Then you can edit and fine-tune the response and print or download it as PDF or Word Document to continue editing in Word.

|

|

Void The Invoice and Tickets

If the chargeback or pre-chargeback notice has arrived before the event, you can simply void the invoice and the tickets, so the tickets are not usable (scannable) and they become available to purchase by others.

Be Prepared, Compensate or Set-Aside Budget for Fraud

Lastly, while you do your best to prevent and minimize the fraud and chargebacks, unfortunately, you cannot totally eliminate that and so, you have to be prepared and set aside budget for that, in the same way that you put aside budget for all other expenses, or a physical store puts aside budget for shoplifting and other expenses.

For example, if you get 1 lost chargeback per 100 invoices, you can assume that your estimated chargeback / fraud percent is 1% and you should accommodate 1% of your sales to that.

Or you may decide to transfer this charge to the buyers, by adding 1% to your service charge or ticket price, which you can easily do on Ticketor.

*Information in this document or throughout Ticketor are not legal or financial advice and should not be considered as one.